DeFi Layer

Typically, governance tokens for Layer 2 (L2) protocols don't have a direct connection to the protocol itself other than enabling proposal creation and voting. We aim to innovate by creating protocol revenue through DeFi activities through the Taffy DeFi platform.

So what is Taffy?

Taffy is a specialized decentralized exchange (DEX) built on the Saakuru blockchain protocol, a pioneering gasless network designed to remove transaction costs from the user experience. As a fork of Uniswap v2, Taffy brings the trusted mechanics of a proven DEX model but with significant enhancements tailored for the GameFi sector and the trading of SATS (Bitcoin Satoshi-pegged token). The integration of staking pools within Taffy allows gamers and crypto enthusiasts to engage more deeply with communities and their tokens, providing a dynamic platform for interacting and earning rewards. By leveraging the gasless nature of the Saakuru chain, Taffy not only facilitates seamless (instant transactions) and cost-effective trading of GameFi tokens but also positions itself as a hub for the community at the exciting crossroads of gaming and decentralized finance.

Specifically, a fee from each swap will be allocated as protocol revenue. The overall trading fee on Taffy (DEX Fee) is 0.3%, similar to Uniswap V2 but without gas-fee costs. Of this fee, ~16.67% (0.05%) will be rewarded to Taffy token holders who stake the token. The Saakuru team owns 25% of Taffy team tokens, which will be used to stake for protocol revenue from the fee share, with the remaining team tokens owned by other founding members. Part of these reward tokens will go to the “Trade-to-Win” pool, while the rest of the fee will be paid to the liquidity providers (LPs). Additionally, Saakuru will launch pairs and liquidity pools on Taffy DEX, enabling Saakuru holders to facilitate gas-less trading with instant transactions. Initially, pairs SKR/USDC and SKR/OAS are live. Thus, the more successful the games and applications built on the Saakuru Protocol are, the higher the protocol revenue, which will, in turn, be used to burn SKR tokens, enhancing their value.

What can you do with Taffy DEX?

1. Swap

The first version of Taffy provides users with access to swap top official MEME coins and GameFi tokens deployed on the Saakuru chain with no gas fee. This will allow users to avoid the headache of spending precious native coins for their trading activities.

Overall trading fee on Taffy (DEX Fee) — 0.3% (similar to Uniswap V2, but no gas-fee cost)

~16.67% of the fee (0.05%) will be rewarded to Taffy token holders who staked the token. The Saakuru team owns 25% of Taffy team tokens, which will be used to stake for protocol revenue from the fee share. The rest of the team tokens are owned by other founding members. Part of these reward tokens will go to the “Trade-to-Win” pool.

The rest of the fee will be paid to the liquidity providers (LPs).

Saakuru will also launch pairs and liquidity pools on top of Taffy DEX so Saakuru holders can facilitate Gas-less trading with instant transactions. Initially, Saakuru will launch pairs SKR/USDC and SKR/OAS.

2. Liquidity and Staking rewards

Liquidity pools on Taffy play a critical role in ensuring the platform remains liquid and trading pairs are always available. By depositing assets into these pools, liquidity providers earn transaction fees based on the trading activity related to their contributed assets. This incentivizes users to supply liquidity, supporting the overall health and efficiency of the exchange while enabling them to gain passive income from their holdings.

Staking pools on Taffy offer users an opportunity to stake their tokens in return for rewards, further integrating the gaming community into the DeFi ecosystem. These pools not only help secure the network but also allow token holders to earn additional tokens as a reward for their participation. This feature is particularly attractive for long-term holders looking to maximize the yield on their holdings.

When someone swaps $1000 worth of assets you have provided liquidity to on Uniswap, a 0.25% fee ($2.50) is distributed across all liquidity providers. The moment you withdraw your liquidity, you will claim your share of the accumulated fees based on your proportion of ownership in the liquidity pool.

In addition to earning fees for providing liquidity, Taffy DEX offers another excellent way to earn more rewards through staking. Users who provide liquidity can also stake their LP tokens (tokens received after providing liquidity) in short-lockup staking pools. These pools generate rewards sourced from various GameFi communities.

As of May 28, 2025, some of the pools offer up to 2300% APY with just a 1-month lock-up period. Stakers can earn SATS and USDC tokens based on their preferences. Additionally, Taffy, Saakuru, and their partners will soon provide more short-lockup staking pools.

3. Trade to Win?

In the near future, Taffy DEX will introduce the innovative “Trade to Win” feature, designed to reward users not just for trading but for actively engaging with the platform. As users trade across various liquidity pairs, they will accumulate points that can be used for dual benefits: redeeming in-game items and securing early access to new projects launched on the platform. This gamified trading system enhances the overall user experience by merging finance with entertainment and deepens user involvement by offering tangible rewards that extend beyond the trading floor.

Taffy plans to introduce a lottery feature, adding an element of excitement and potentially high reward for platform users. Participants will be able to enter the lottery using a small amount of their holdings, with the chance to win larger sums — integrating a traditional gaming element into the crypto exchange environment. This feature is anticipated to drive further engagement by combining the thrill of gaming with the financial incentives of cryptocurrency trading.

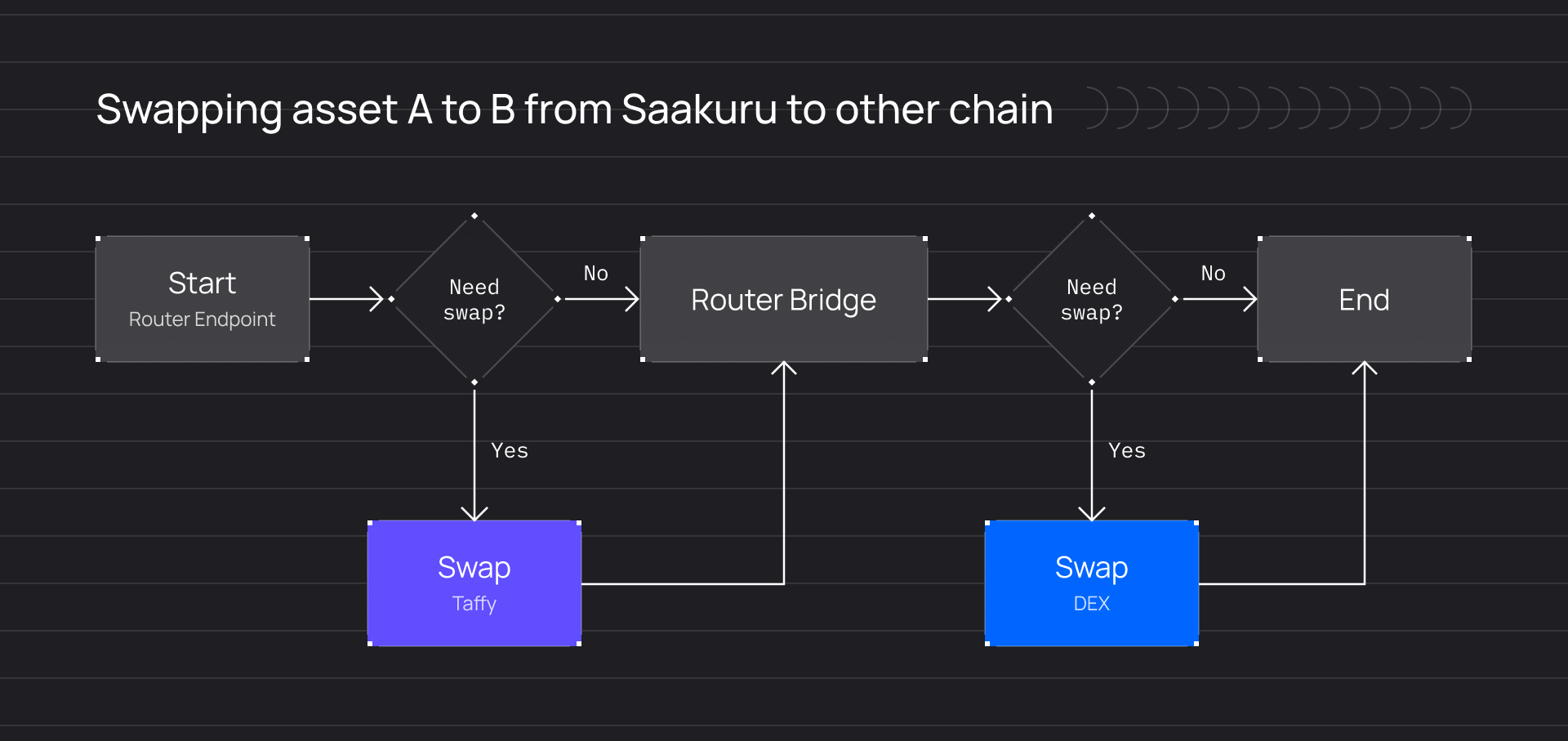

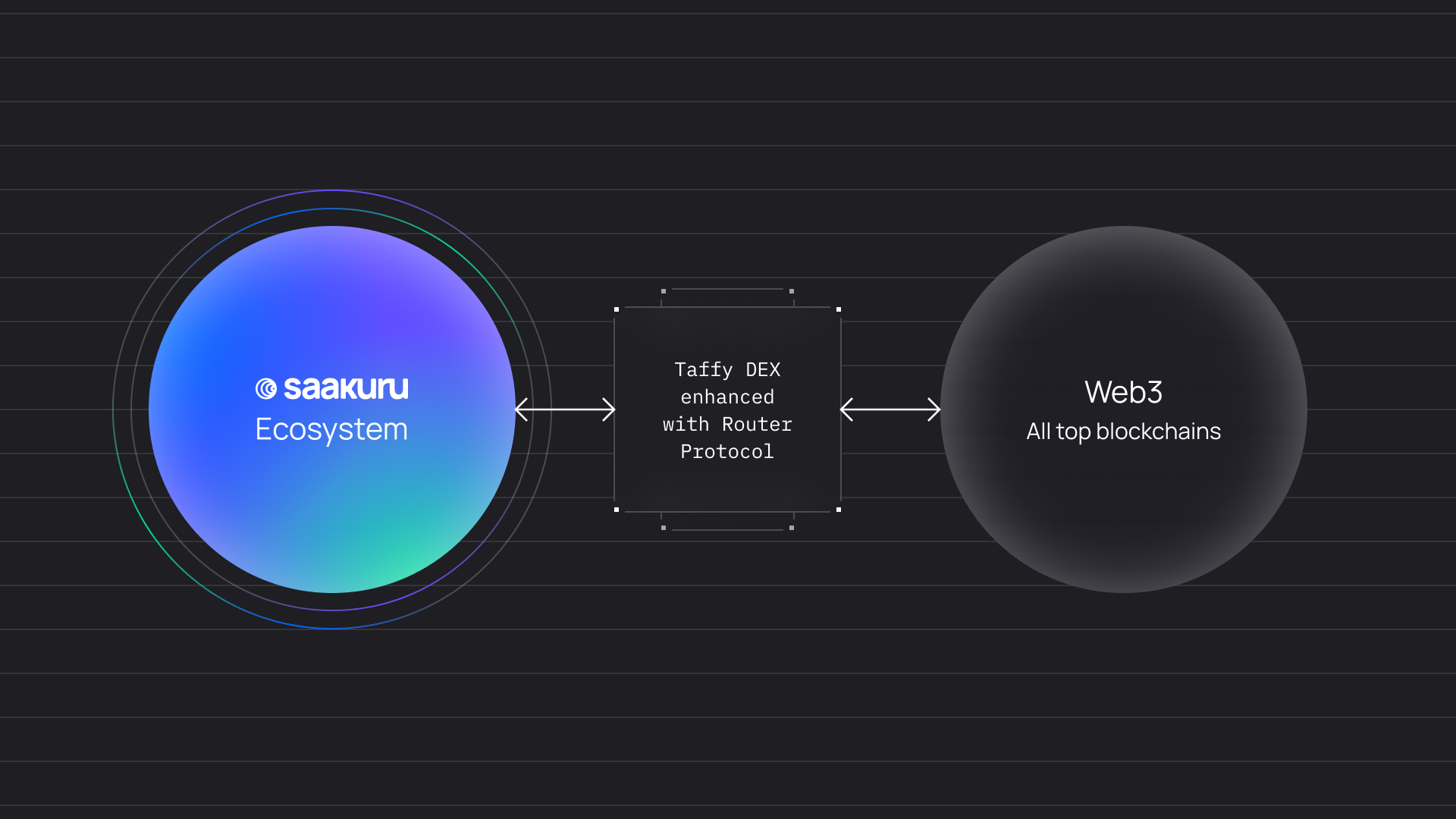

4. Cross-chain capacities

Although the Taffy DeFi platform is currently the exclusive DEX (Decentralized Exchange) provider on the Saakuru Protocol, plans are underway to expand its availability to other protocols in the future. This expansion means that swap activities conducted on these other protocols will also contribute to generating revenue for the Saakuru Protocol. This approach not only diversifies the revenue streams of the Saakuru Protocol but also strengthens the utility and value proposition of the TAFFY tokens beyond the confines of a single protocol environment.

Overview

The Taffy DeFi Platform is a joint venture between Saakuru Labs and a team of DeFi experts aimed at improving the DeFi space, especially decentralized exchanges (DEXs). This partnership focuses on enhancing user experiences by making DEXs more functional and easy to use. Taffy leverages the Saakuru blockchain, known for its gasless transactions, and introduces a novel liquidity management system with both hot and cold pools. In addition, Taffy employs gamification strategies to boost activity and liquidity for each liquidity provider (LP). These features position Taffy to lead in efficiency, ease of use, effective liquidity management, and engagement within the DeFi world.

Was this helpful?